Bo Sivenius

Toyota Material Handling Manufacturing Sweden. about Alight

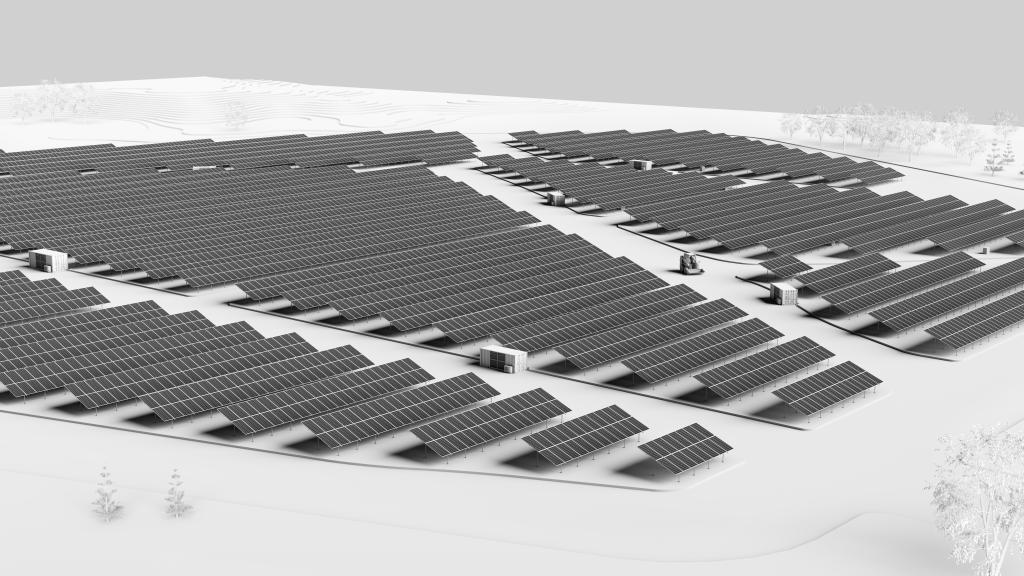

At Alight, we help energy-intensive businesses switch to solar. We build, operate and own onsite and offsite solar projects, and sell that clean power to companies at a low, fixed cost backed by power purchase agreements (PPAs). Together, we’re accelerating the transition to a more sustainable future.

Bo Sivenius

Toyota Material Handling Manufacturing Sweden. about Alight

Power your operations with electricity from a solar park through an offsite PPA.

Put solar panels on your site and use the electricity directly to power your operations with an onsite PPA.

Generate solar power on nearby land and use it directly at your site through a private wire PPA.

energy assets under management or construction

solar power capacity under management or construction

pipeline of PPA projects under development across Europe

team members across Europe