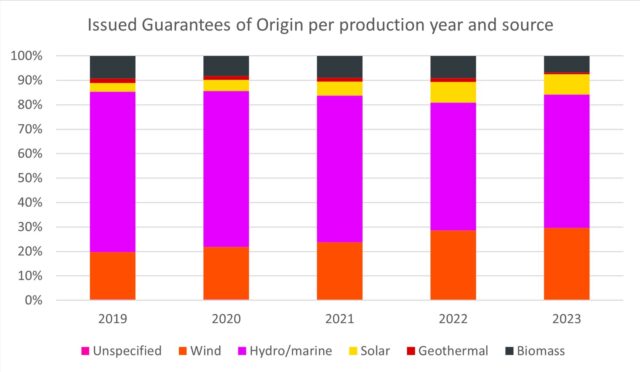

The concept of additionality is gaining recognition as a more efficient way to decarbonise electricity supply

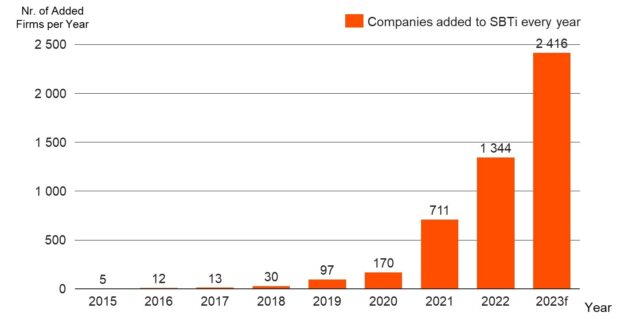

There is a growing concern about the insufficient impact of buying GOs, as it doesn’t necessarily drive real change to the energy mix. Organizations like SBTi, RE100, and GHG Protocol are reviewing their approaches to scope 2 emissions accounting to promote more impactful renewable energy procurement practices.

The EU recognizes the importance of additionality, adopting new rules for production of renewable hydrogen and hydrogen-derived fuels (renewable fuels of non-biological origin, RFNBO). Green hydrogen producers must match power consumption on an hourly basis with additional renewable energy production that would otherwise not be used. From 2038, they must source their renewable electricity from installations that have been in operation for less than 36 months before the electrolyser. The “additional” renewable energy demand will likely be significant as the Commission estimates that around 500 TWh of renewable electricity is needed to meet the 2030 ambition in REPowerEU of producing 10 million tonnes of RFNBOs.

Tightening requirements are likely to underpin a high demand for GOs, especially from young and additional assets

New reporting criteria and new best practices in energy procurement will have ripples on market demand for GOs.

“It is impossible to say exactly what the outcome will be in an unpredictable market. But one thing seems certain: Demand for renewable energy will remain high and the GO market will become more fragmented, with some young or additional energy sources being valued higher than others,” says Miranda. “Companies with ambitious climate targets are wise to secure long-term access to green energy and future proof sustainability claims.”