Strategic driver 2: Sustainability

While solar panels operate without emitting CO2, they possess an embedded carbon footprint from manufacturing, transport, installation, and decommissioning. The sustainability evaluation involves calculating the emissions difference between the grid and solar PV (residual mix approach) to approximate carbon avoidance provided by the project. The UK grid emissions factor varies, but is roughly 200 kg of CO2 per MWh, compared to a solar PV life cycle emissions factor of 30 kg of CO2 per MWh. Based on a difference of 170kg of CO2 per MWh and our offsetable demand of 2,000M Wh per year, we would expect a reduction of 340,000 kg of CO2 per year, or 340 tonnes.

The result informs the year-one emissions reduction, a critical metric for assessing the immediate environmental impact and setting a plan to reach net-zero. Further, projections for future emissions reduction necessitate considering the expected decrease in the UK grid emissions factor over time.

Strategic driver 3: Security

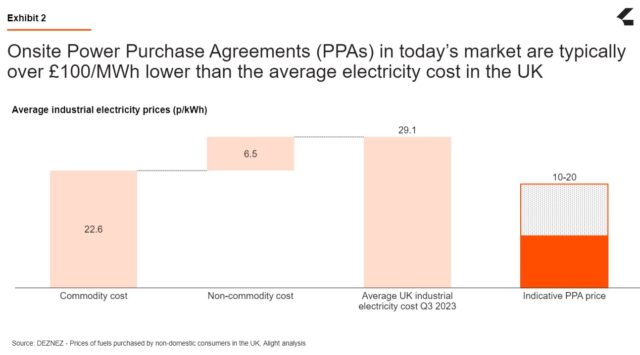

Security, a multifaceted consideration, encompasses both price certainty and resilience. A rooftop solar installation offers price certainty, enabling accurate business planning and mitigating the risk of power price spikes witnessed in recent volatile markets.

Equally crucial is resilience during disruptions, such as power cuts, especially with the increasing integration of intermittent renewables onto the grid. As a result, there is a growing appetite to co-locate storage with rooftop solar, not only to improve resilience but also to generate revenue through arbitrage and ancillary services for the UK grid.

While price security is relatively straightforward to quantify, the valuation of resilience remains challenging. Nonetheless, acknowledging its growing importance sets the stage for future assessments and underscores the resilience of a solar-powered infrastructure.

Summary

Navigating the terrain of industrial rooftop solar can seem complex and challenging. As your business embarks on this transformative path, we encourage a judicious balance between detailed projections and simplified assumptions. “It’s not merely about presenting numbers; it’s about winning the hearts and minds of stakeholders across the organisation, ranging from site managers to C-suite executives,” says Xander.

At Alight, we work alongside our customers to construct a tailored and compelling case for rooftop solar. In a landscape where savings, sustainability, and security intertwine, rooftop energy generation is truly a no-regret move.